change in net working capital dcf

Change In Other Working Capital as of today June 17 2022 is 000 Mil. The non-cash working capital for the Gap in January 2001 can be estimated.

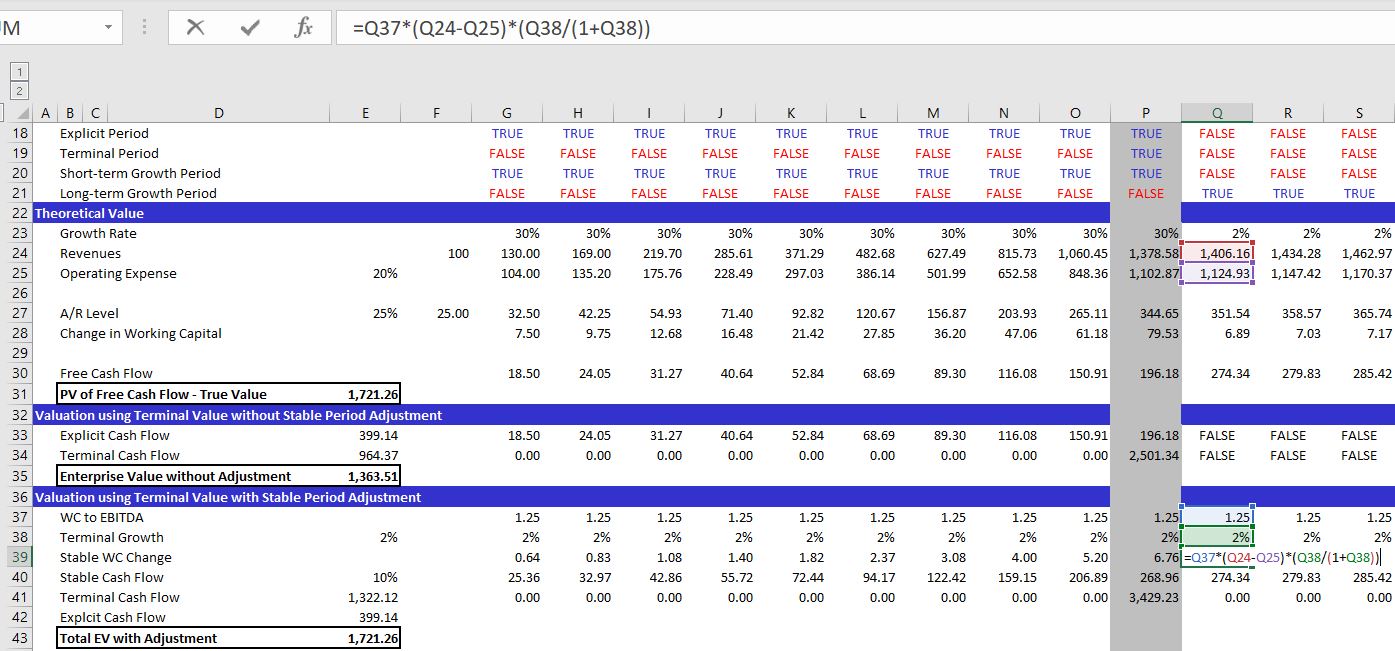

Normalised Cash Flow In Dcf Working Capital Taxes And Stable Roic Edward Bodmer Project And Corporate Finance

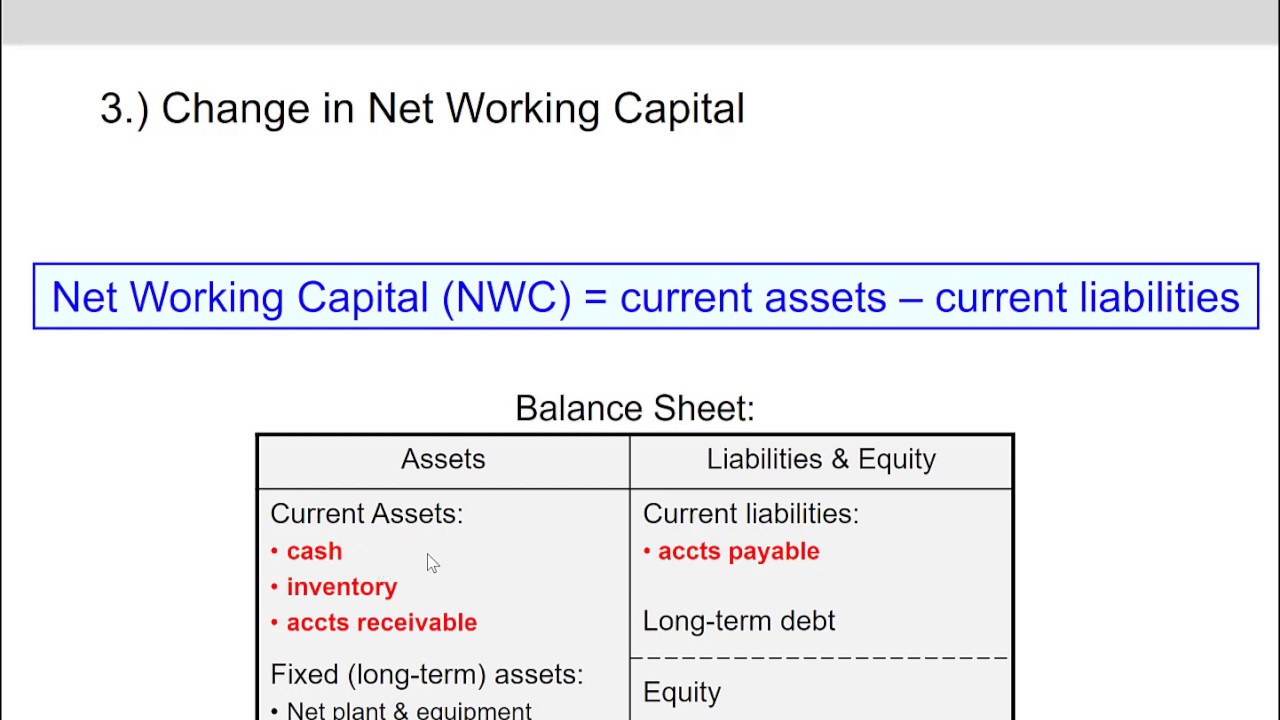

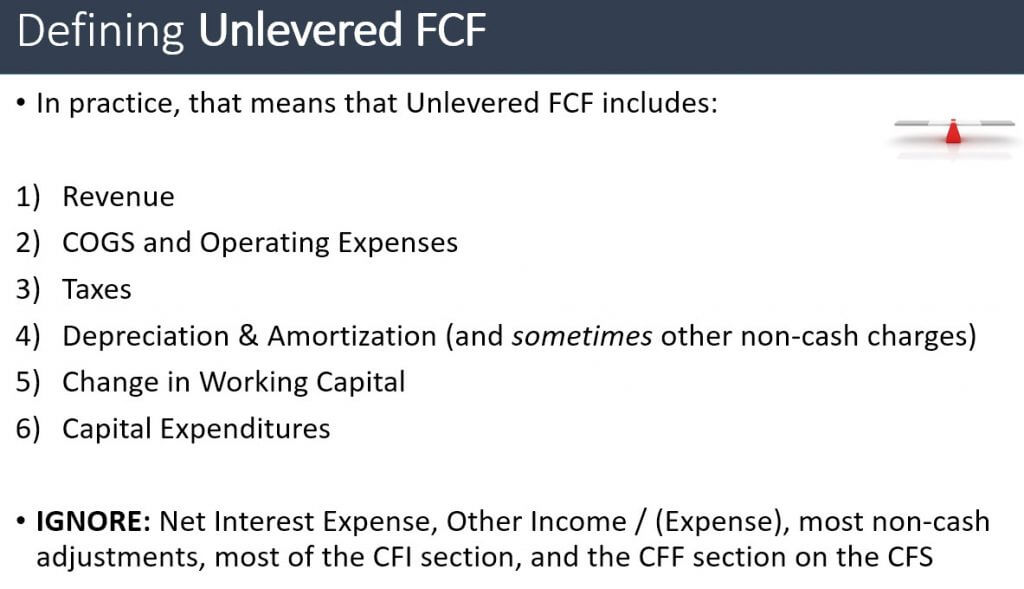

Look closely at the image of the model below and you will see a line labeled Less Changes in Working Capital this is where the impact of increasesdecreases in accounts receivable inventory and accounts payable impact the unlevered free cash flow of a firm.

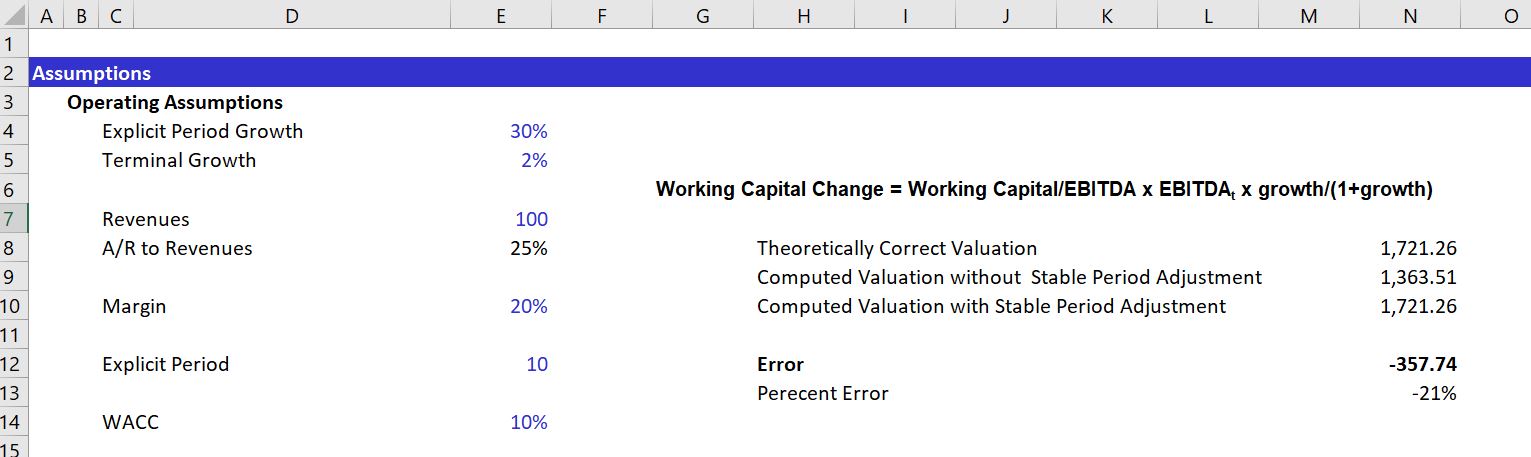

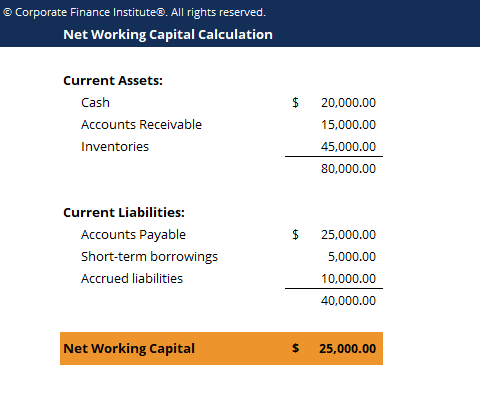

. Non-cash working capital 1904 335 - 1067 - 702 470 million. How do you project changes in net working capital NWC when building your DCF and calculating free cash flow. The Change in Net Working Capital NWC section of the cash flow statement tracks the net change in operating assets and operating liabilities across a specified period.

If the change in NWC is positive the company collects and holds onto cash earlier. Changes 2017 AR 2016 AR 2017 Inventory 2016 Inventory 2017 AP 2016 AP Where AR accounts. Converting Accounting Earnings into Cashflows.

Change in Working Capital Summary. In depth view into. Year 2 Working Capital 180m 190m 10m.

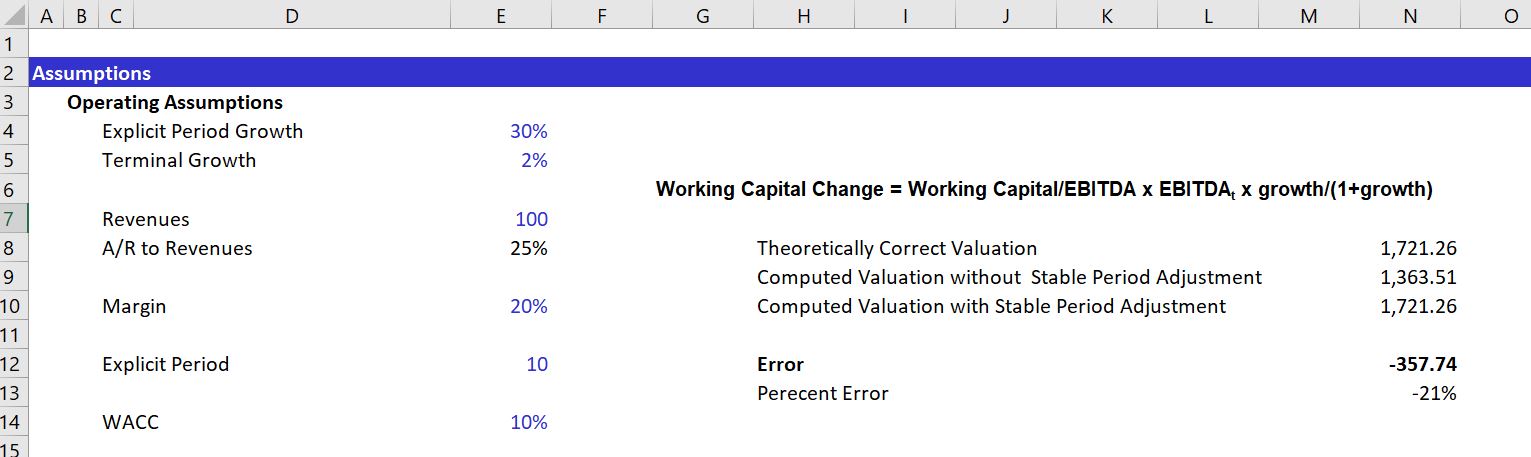

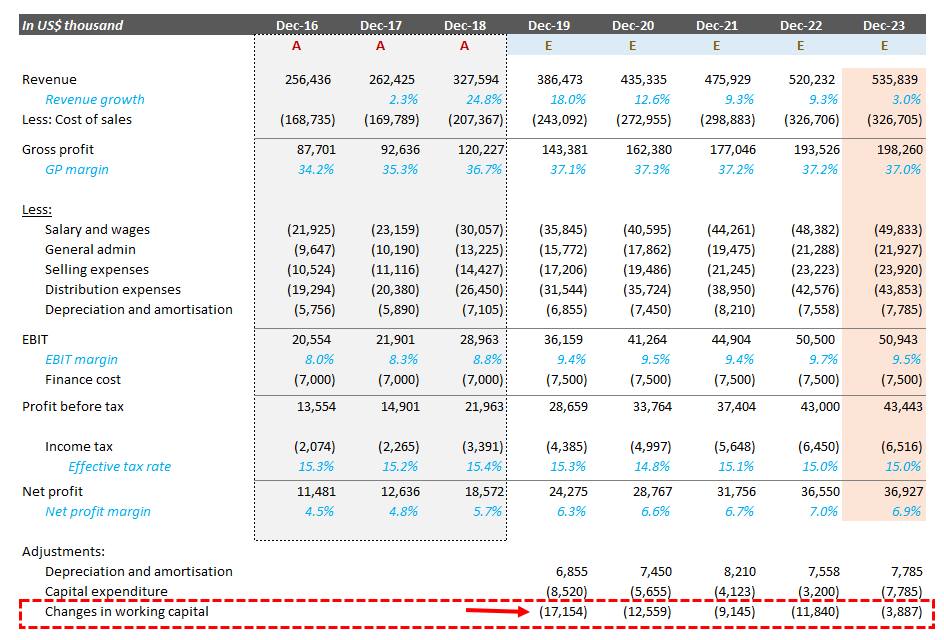

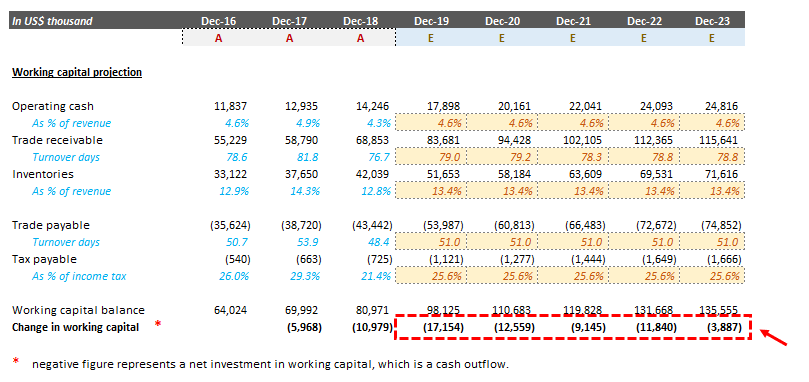

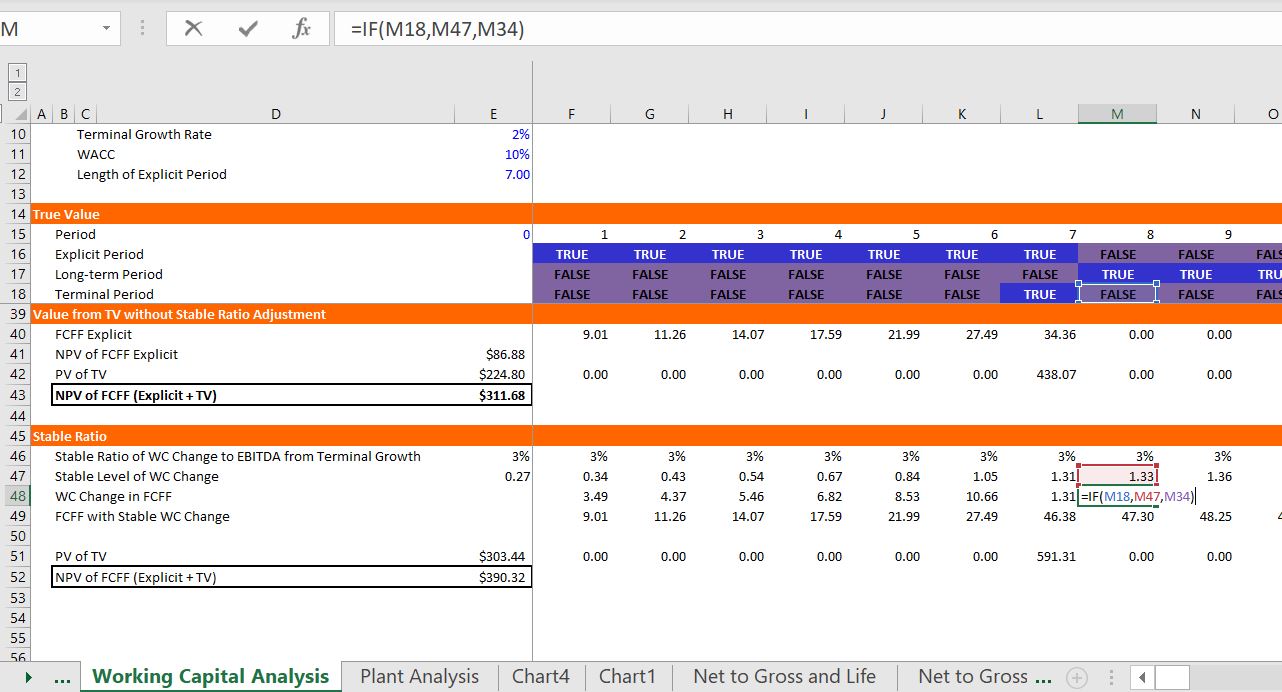

In Year 1 the working capital is equal to negative 5m whereas the working capital in Year 2 is negative 10 as shown by the equations below. Stable WC Change WCEBITDA EBITDA t terminal growth1terminal growth. In this video I cover the different ratios tha.

Thats why the formula is written as - change in working capital. Most businesses have lumpy working capital. Change in Net Working Capital is calculated using the formula given below.

Using operating cash flow numbers straight from a companys filings can cause huge swings in DCF models because of changes in working capital. Changes in Net Working Capital The change of accounts required to perform the business such as changes in receivables inventory and payables which affect the cash flow statement. Your Change in net working capital dcf images are available in this site.

Accounts Payable 45m 65m. CAPEX Capital expenditures The required capital investments such as investments in tangible and intangible assets for the years to come. The negative working capital values stem from increases in.

The implications of this assumption in a long-term forecast must be carefully analyzed. PV 66240 1 8261. Change in Net Working Capital 12000 7000.

It flows down the structure of the chart like below. Calculate the change in working capital. Working Capital The Gap.

Determine whether the cash flow will increase or decrease based on the needs of the business. Working Capital The Gap. Thus the formula for Cash From Operations CFO is.

Add or subtract the amount. Its defined this way on the Cash Flow Statement because Working Capital is a Net Asset and when an Asset increases the company. If youre asking whether you include cash in the CA to get to change in net working capital the answer is no.

Positive cash flow indicates that a companys liquid assets are increasing. Cash Flow is the net amount of cash and cash-equivalents being transferred in and out of a company. Change in Net Working Capital Net Working Capital for Current Period Net Working Capital for Previous Period.

Since the change in working capital is positive you add it back to Free Cash Flow. CFO Net Income non-cash expenses increase in non-cash net working capital. The second file includes other working capital items and has a bit more detail In evaluating stable working capital both files demonstrate that you can use the following formula in the terminal period for stable working capital.

Changes in net working capital impact cash flow in financial modeling. Lets start with the numbers - revenue is up 100. Year 1 Working Capital 140m 145m 5m.

Nov 22 2017 - 1108pm. An example of the first year is as follows. On the Cash Flow Statement the Change in Working Capital is defined as Old Working Capital New Working Capital where Working Capital Current Operational Assets Current Operational Liabilities.

69764 092 11826 for all five years each year using the previous discount rate divided by calculations to realize the current discount rate. However if the change in NWC is negative the business model of the company might require spending cash before it can sell. Add back the depreciation and amortization charges.

Although they are considered expenses from an accounting perspective thus deducted in the. The entire intuition behind CA-CL is to arrive at how cash has changed over the period increases in CA use of cash increase in CL source of cash--in that sense you would use non-cash CA - CL to get to FCF to do your DCF. In Table 1010 we report on the non-cash working capital at the end of the previous year and the total.

A negative change in working capital working capital forecast to decrease is also possible in certain businesses and at certain times such as when a business is experiencing a downturn in its markets. The goal is to. The change in net working capital formula is given as N E B where E is ending net working capital and B is beginning NWC.

Calculate the change in working capital. Change In Other Working Capital explanation calculation historical data and more. All else held constant this results in net income up 60 assuming a 40 tax rate.

Change in the net working capital is the change in net working capital of the company from the one accounting period when compared with the other accounting period which is calculated to make sure that the sufficient working capital is maintained by the company in every accounting period so that there should not be any shortage of funds or the funds should not lie idle in future. Step 1 Cash From Operations and Net Income. In Table 1010 we report on the non-cash working capital at the end of the previous year and the total revenues in each year.

Moving to cash flow statement - net income is up 60 but change in working capital is a 100 outflow increase in AR resulting in a 40 decline in cash. Cash From Operations is net income plus any non-cash expenses adjusted for changes in non-cash working capital accounts receivable inventory accounts payable etc. Change in Net Working Capital 5000.

Change in net working capital dcf are a topic that is being searched for and liked by netizens today. The formula for the change in net working capital NWC subtracts the current period NWC balance from the prior period NWC balance.

Change In Working Capital Video Tutorial W Excel Download

10 Of 14 Ch 10 Change In Net Working Capital Nwc Explained Youtube

Step By Step Guide On Discounted Cash Flow Valuation Model Fair Value Academy

Change In Working Capital Video Tutorial W Excel Download

Net Working Capital Template Download Free Excel Template

Change In Net Working Capital Nwc Formula And Calculator

Change In Net Working Capital Nwc Formula And Calculator

Changes In Net Working Capital All You Need To Know

11 Of 14 Ch 10 Change In Net Working Capital Nwc Example Youtube

Change In Working Capital Video Tutorial W Excel Download

Step By Step Guide On Discounted Cash Flow Valuation Model Fair Value Academy

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Change In Net Working Capital Nwc Formula And Calculator

Normalised Cash Flow In Dcf Working Capital Taxes And Stable Roic Edward Bodmer Project And Corporate Finance

Change In Working Capital Video Tutorial W Excel Download

Normalised Cash Flow In Dcf Working Capital Taxes And Stable Roic Edward Bodmer Project And Corporate Finance

Change In Net Working Capital Nwc Formula And Calculator

Projecting Net Working Capital For Free Cash Flow Calculation Dcf Model Insights Youtube

Normalised Cash Flow In Dcf Working Capital Taxes And Stable Roic Edward Bodmer Project And Corporate Finance